We all aspire to save money and break free from the burden of debt. However, with a significant portion of the population (77%) in debt, setting aside savings and giving to others can be challenging.

No matter how small, saving any amount of money will improve your financial well-being. But how can you save money with high expenses and a modest salary? A difficult task like this can become more manageable with the right approach. Gain insights from the summaries of bestselling books by renowned authors, such as 'The Total Money Makeover,' 'The Simple Path to Wealth,' and 'Know Yourself, Know Your Money,' which are available in our library. This article will show you how to manage your budget wisely to keep more money in your wallet.

The psychology of money management

Why is money-saving difficult? The reasons may differ:

Monthly income is not enough even to cover basic living expenses

Unforeseen events require urgent, unexpected expenses

Living in the present, the feeling that by saving, you are denying yourself the joys of life as impulse purchases

Insufficient motivation to make systematic savings

Unfortunately, there is no single recipe for quickly and easily improving your financial situation. Still, systematic financial planning can reduce the stress of managing personal finances and increase the likelihood of achieving your financial goals.

How smart saving today secures your financial freedom tomorrow

Managing debt and monthly loan payments can feel overwhelming, but living within your means while still saving can completely transform your outlook. It fosters a sense of peace and confidence, making life much more enjoyable, don't you think? Here's more on why saving matters:

1. Building financial security: Americans experience significant stress due to money problems. According to a MarketWatch survey, 65% of respondents cite finances as their number one source of stress, with 88% reporting some financial stress. The high costs, insufficient savings, and stagnant income drive this strain. Having several months of savings can reduce stress from unforeseen events and increase your freedom in managing life.

2. Creating emergency protection: An emergency fund marks the first step toward financial stability, independence, and freedom. In The Total Money Makeover, Dave Ramsey advises creating an emergency fund — an accumulated amount equal to three, six, or twelve months of expenses for yourself or your family. It is your financial safety net for an unforeseen event, your cash for a rainy day in case of situations like job loss or family illness.

3. Enabling future purchases: Saving helps you reach specific saving goals. Soon, you might encounter something like a profitable option for education or household appliances. In this case, you need extra money that you could use. Of course, you can use a credit card, but having some savings will allow you to make these purchases more freely.

4. Increasing life flexibility: Saved funds give you more choices in life. You can decline unfavorable job offers, take time to plan your future, or spend more time with loved ones.

5. Supporting long-term planning: Long-term goals often are ineffective motivators. For example, saving for retirement accounts is hard for twenty-year-olds; many say they don't need to. However, reducing the planning horizon to 10 years makes it easier to plan what significant purchases you want to make during this period. A good current goal will motivate savings and finding new opportunities for earning money.

Step-by-step guide to creating a budget

Everyone needs a financial plan, regardless of income level. In today's world, where economic decisions affect almost every aspect of life — from managing your budget to planning for the future — understanding the basics of finance can be a crucial factor in achieving success.

1. Calculate your net income

Know exactly how much you're making and spending at the end of the month. Having an accurate idea of how much money you're making and how much you're paying is the first step to saving. Without this knowledge, it'll be hard to implement a comprehensive savings and budget worksheet. Use budgeting apps, a notebook, or a spreadsheet to track everything you make and spend.

Make sure you know your take-home pay — the amount you receive after taxes, car insurance, healthcare, debt repayments, and other deductions have been taken from your gross monthly salary.

2. Track your monthly expenses

"There are many things money can buy, but the most valuable of all is freedom. Freedom to do what you want and to work for whom you respect." ― J.L. Collins, 'The Simple Path to Wealth'

You might be surprised to see where your money is going and even notice overspending in some areas. Even if reviewing your financial situation makes you nervous, use this tip to help you overcome the discomfort faster. Check your bank statement and credit card debt to understand where your money is actually going each month. Categorize your spending to identify areas where you can cut back.

Food costs often consume a large part of many people's budgets worldwide. Use a weekly meal plan and purchase only the products needed for your planned dishes. It will prevent you from buying too much and throwing it away. It's not only about saving but also about overconsumption.

3. Cancel subscriptions you don't use

Do you rarely use your streaming service subscription? Analyze your spending habits. How much does it cost to use your cellphone? You may only need a more affordable plan, which might be enough.

In 'Know Yourself, Know Your Money,' Rachel Cruze emphasizes that our smartphones have become like supermarkets, allowing money to slip away with just a few purchase notifications after receiving payment. Monitor your subscriptions to track your spending and cancel any you're not using. This simple step can help you save money easily. For example, if you have a gym membership that you rarely use, consider canceling it and switching to free workout videos available online. Minor adjustments like these can significantly impact your budget.

4. Leave your online shopping cart overnight

"You own the things you own and they in turn own you." ― J.L. Collins, 'The Simple Path to Wealth'

Impulsive purchases often lead to overspending. To avoid this, leave your online shopping cart or shopping list overnight to think through your choices. Certified professional organizer Darla DeMorrow adds items to her online shopping carts but waits about a day before purchasing. She says you're not denying yourself a purchase because you can't afford it — you'll just get it later. Also, some stores will email you a discount code to encourage you to complete your purchase.

5. Set SMART financial goals

"Savings without a mission is garbage." ― Dave Ramsey, 'The Total Money Makeover'

The first savings are just the beginning of the path with its pitfalls. A financial goal is a specific task related to the money you want to accomplish over a certain period — for example, saving to buy a car or paying off a loan.

The goal should be specific (following the SMART approach) and meaningful enough to motivate you. Saving just because it's the right thing to do is rarely a good motivator. It's helpful to break a big goal into smaller, more achievable ones. You'll see your victories, which you should celebrate, which will help you feel like a winner.

How it works?

Specific: The goal should be clearly defined. Instead of "I want to save money," set a target like "Save $5,000 for a summer vacation."

Measurable: You should be able to track your progress. For example, saving $500 monthly will help you reach your goal in ten months.

Achievable: The goal should be realistic.

Relevant: The goal should be important to you. For example, saving for education will help advance your career.

Time-bound: Set a specific deadline. For example, "Save $40,000 in two years."

6. Avoid debt and try to pay off your loan

"Look again at those people around you. For most, debt is simply a part of life. But it doesn't have to be for you. You weren't born to be a slave." ― J.L. Collins, 'The Simple Path to Wealth'

J.L. Collins warns against loans in general. High-interest credit card debt, personal and payday loans, title loans, and rent-to-own payments carry interest rates so high that you repay two or even three times the original amount you borrowed. These types of debt can quickly spiral out of control, making it harder to achieve financial stability. Collins proposes a simple formula: Spend less than you earn, invest the surplus, and avoid debt.

7. Develop a budgeting plan

"A budget is people telling their money where to go instead of wondering where it went." ― Dave Ramsey, 'The Total Money Makeover'

Use the 50-30-20 rule as a guideline, adjusting it to suit your financial needs and goals. This money-saving strategy suggests spending 50% of your monthly budget on necessities, such as rent, monthly bills, and childcare; 30% on luxuries, such as dining out or travel; and 20% on savings or investments, such as FDIC-insured or individual retirement accounts (IRAs). According to Dave Ramsey, citing a Bankrate survey, 70% of Americans don't believe they'll be able to retire with dignity.

Plan your savings strategy. Setting short-term savings goals, such as a vacation or a down payment, and long-term goals, like retirement or paying off your student loan, is a good idea. Find out what retirement savings plan your employer offers. If you're having trouble figuring out which retirement savings plan is best for you, consulting with a financial advisor can help.

Effective saving strategies

You can also complicate the spending process to avoid suddenly spending all your savings on another goal. For example, you can put your money in a direct deposit or an investment account, adding an extra step. Alternatively, you can put your money in another debit card, which requires a transfer to your current account. This technique will allow you to reconsider whether you're ready to spend the money you've been saving for so long.

Set up automatic transfers to savings accounts

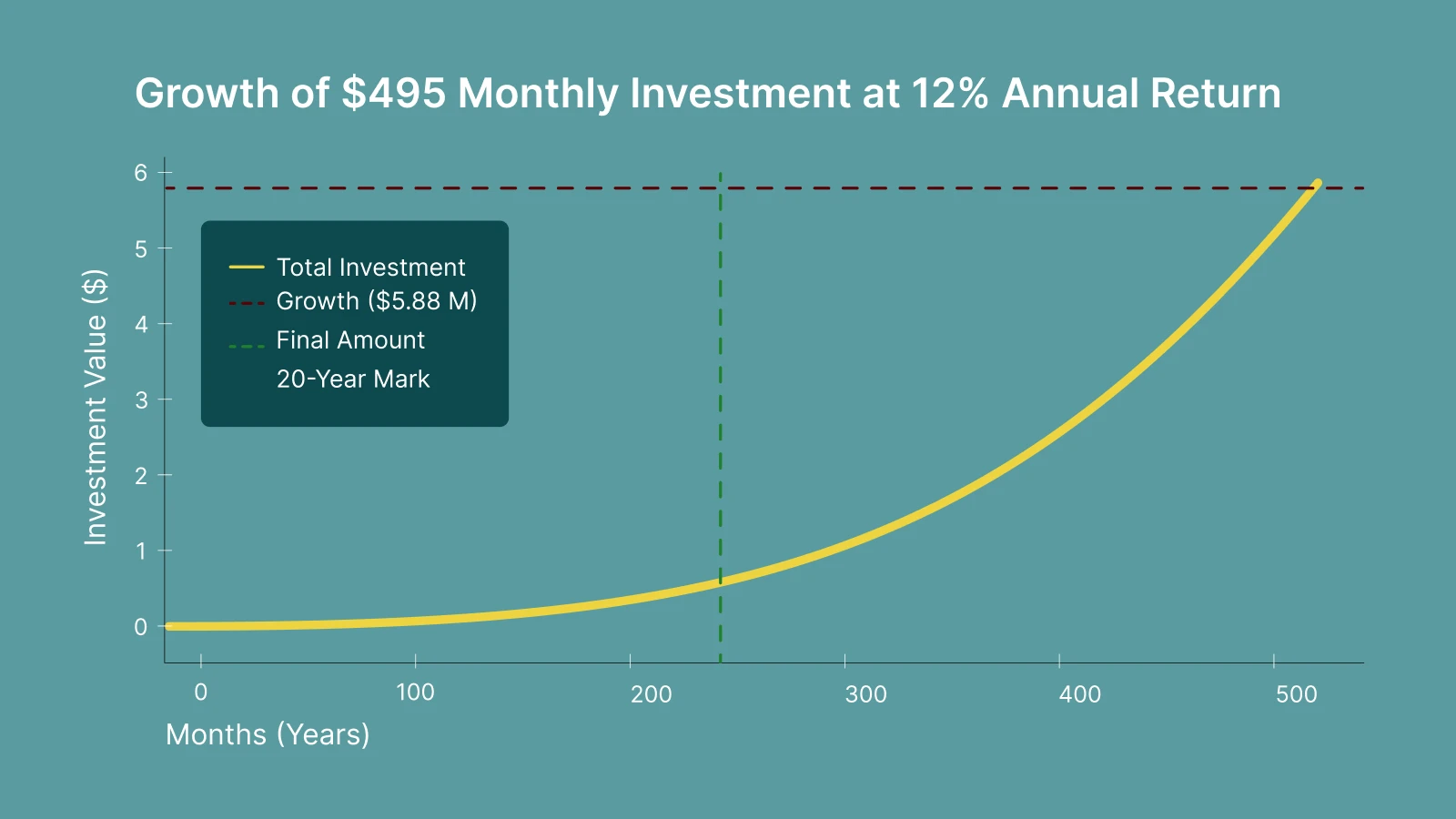

"If you keep a $495 car payment throughout your life, which is "normal," you miss the opportunity to save that money. If you invested $495 per month from age twenty-five to age sixty-five, a normal working lifetime, in the average mutual fund averaging 12 percent (the eighty-year stock market average), you would have $5,881,799.14 at age sixty-five. Hope you like the car!"― Dave Ramsey, 'The Total Money Makeover'

Automatically put a portion of your paycheck into savings. Start by splitting your paycheck between different accounts. Setting aside funds in a separate account or savings goal can help avoid overspending. While it sounds obvious, your savings depends on your finances. It could be a fixed monthly amount or a percentage of your income. Either way, a realistic savings goal considering your expenses is a good idea. Small savings goals are more achievable, and no amount is too small.

Top budgeting apps to simplify your money management

Software is the most comfortable way to monitor expenses and income and manage your money. Having it readily available on your smartphone makes tracking easier.

Use cashback apps like Ibotta. Have you heard about using cashback apps? Some apps offer cashback on purchases, while others reward you with gift cards for taking pictures of receipts. Many also provide coupons. Before shopping online or heading to the store, look for coupons or promo codes to help you save money.

2 Monefy: Here, you can control and track expenses. You can manually record or take pictures of your receipts to track all costs. The app categorizes expenses: Simply select the appropriate icon (clothes, food, restaurants, taxis, sports, gifts, pets) and enter the amount.

3 Honeydue: Competent budget management is crucial for married couples. This app helps them jointly control cash flow and distribute expenses. It also has a built-in chat, making it convenient to discuss plans for shopping, loan payments, and other essential operations.

4 The Bills Monitor: This tool distributes expenses for mandatory payments, such as mortgages, utility bills, repairs, loans, taxes, and insurance. It also includes categories for everyday expenses, such as food, pets, and children. To avoid missing payments, you can set a reminder for each payment for a day, several days, or a week.

5 The Wallet: It allows you to localize digital versions of plastic cards in one place. Besides credit and debit cards, it's also an excellent tool for storing other virtual cards, such as loyalty bonus cards, coupons, club cards, digital keys to vehicles and premises, and tickets.

Get expert advice and enhance your financial knowledge with the Headway app

Small, consistent steps can lead to significant financial stability and peace of mind. Download the Headway app to explore book summaries that can help you master your financial future.

Want to dive deeper into expert money-saving and budgeting insights? Check out our collections of budgeting and finance book summaries.

What makes the Headway app the perfect choice for you?

You only need about 15 minutes to understand key ideas from self-help books.

The Headway app recommends books based on your interests.

You can set growth goals in the app to make it work best for you.

The summaries are convenient in both text and audio format.