So you just finished 'The Richest Man in Babylon' and now you're side-eyeing your savings account? Yeah, those ancient Babylon parables hit differently when you realize you've been treating money like your broke college self always did.

George S. Clason knew what he was doing back in 1926. He wrapped financial wisdom in stories because he knew that nobody wanted to read a budgeting textbook. (Let's be real here — wouldn't you rather scroll TikTok than read about compound interest?)

But, there's good news! We found 14 more books that'll make you want to learn about money. These aren't your dad's dusty finance books. We're talking page-turners from authors like Robert T. Kiyosaki and Napoleon Hill, who agree that personal finance shouldn't feel like homework.

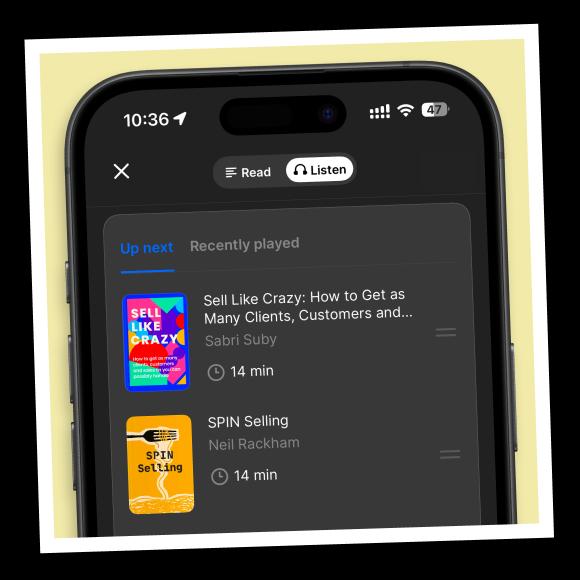

Want the Cliff Notes? The Headway app turns these and similar bestsellers into 15-minute audiobook summaries. They're perfect for your commute when you're too tired to crack open another 300-page book about financial independence.

Download the Headway app to build habits that will build your wealth.

Quick answer: What are the five best books, like 'The Richest Man in Babylon,' to read in 2025?

'Rich Dad Poor Dad' by Robert T. Kiyosaki: Two dads, two money mindsets, and one life-changing lesson about assets vs. liabilities.

'The Millionaire Next Door' by Thomas J. Stanley & William D. Danko: Spoiler alert: real millionaires drive Toyotas, not Lambos.

'The Intelligent Investor' by Benjamin Graham: Wall Street wisdom without the Wall Street ego.

'Think and Grow Rich' by Napoleon Hill: The OG self-help book that actually delivers.

'Your Money or Your Life' by Vicki Robin: When you realize you're trading life hours for stuff you don't need.

Top 14 books that'll change how you think about money

📘 Want financial transformation fast? Start Headway for money mindset shifts in 15 minutes each!

1. 'Rich Dad Poor Dad' by Robert T. Kiyosaki

Remember when you thought a house was an asset? Kiyosaki's about to ruin that for you. Through stories of his two "dads" — his actual father and his best friend's father — he shows why the rich think differently about money.

What clicks for readers:

Assets put money IN your pocket. Liabilities take it out. (Yes, your car is a liability. Sorry.)

Financial literacy beats a high salary every time.

The rat race is optional if you know the rules.

Why it pairs well with Babylonian wisdom: Both use parables to make you go "ohhhh" about money. Both are American bestsellers that became global phenomena. And both will make you rethink everything your parents taught you about wealth.

Try this: Next paycheck, ask yourself — am I buying an asset or a liability?

2. ‘The Millionaire Next Door’ by Thomas J. Stanley

You know your flashy neighbor, the one with the BMW? They're probably broke. The boring guy with the 10-year-old Honda? Might be worth millions. Stanley and Danko spent years studying actual millionaires in America, and what they found will surprise you.

The reality check:

Most millionaires live below their means (way below).

They budget everything. Yes, even when they're rich.

They'd rather be wealthy than look wealthy.

The Babylon connection: Just like those ancient merchants who saved their gold coins, modern millionaires build wealth quietly. No Instagram stories needed.

3. ‘The Simple Path to Wealth’ by J.L. Collins

Collins started writing letters to his daughter about money. Turns out, we all needed those letters. He makes the stock market feel less like Vegas and more like your boring (but reliable) best friend.

The game plan:

Pay yourself first (sound familiar?)

Index funds are your friend.

Keep it simple — seriously, that's it.

Why Babylon readers love it: Both books say the same thing: wealth building isn't a fantasy. It's a direct result of being consistent.

4. 'The Total Money Makeover' by Dave Ramsey

Ramsey's like that tough-love friend who tells you to stop buying $7 lattes when you're $30k in debt. His baby steps method has helped millions get their financial lives together.

The wake-up call:

Debt is not a tool; it's a trap.

Keep emergency funds before everything else.

Eat rice and beans until you're free.

Classic Babylon vibes: Remember "A part of all you earn is yours to keep"? Ramsey just says it louder and with a more Southern accent.

📘 Need that financial wake-up call? Get Headway for debt-free wisdom from money mentors!

5. 'The Intelligent Investor' by Benjamin Graham

This book is what Warren Buffett calls the best book on investing. Ever. Graham teaches you to treat Wall Street like a business decision, not a casino.

The mindset shift:

Mr. Market has bipolar disorder — use that to your advantage.

Value investing beats speculation.

Patience pays (literally).

Why it's a must-read: Like 'The Richest Man in Babylon,' it turns complex ideas into simple truths. It's a great book for anyone tired of losing money on meme stocks.

6. 'Think and Grow Rich' by Napoleon Hill

Before every self-help book ever, there was Napoleon Hill. He interviewed the richest Americans of his time and found 13 principles they all shared.

The formula:

Desire + faith + persistence = success.

Positive thinking actually works (when paired with action).

Your thoughts literally shape your bank account.

The timeless factor: Published in 1937, but still a bestseller. That's staying power even Babylonian merchants would respect.

📘 Want Hill's 13 principles mastered? Get Headway for the complete wealth formula in 15 minutes!

7. 'The 4-Hour Workweek' by Tim Ferriss

Ferriss asks the question we're all thinking: why work 40 years to retire when you could design your life now? He did it, moving from 80-hour weeks to 4-hour weeks while making more money.

The blueprint:

Automate income streams.

Outsource everything you can.

Mini-retirements > waiting until 65.

For small businesses and dreamers: If Babylon taught saving, Ferriss teaches earning differently. Both lead to financial freedom.

8. ‘Who Moved My Cheese’ by Spencer Johnson

8. ‘Who Moved My Cheese’ by Spencer Johnson

Four characters. One maze. Disappearing cheese. This read will change how you think about the rules by which the world is organized.

The lesson:

Cheese doesn't last forever.

Why readers need this: AI takes our jobs right now. Companies crash every day. You need to know how to pivot.

9. 'The Compound Effect' by Darren Hardy

Small changes can yield massive results. Hardy proves that success isn't about huge leaps. It's about tiny choices that compound over time.

The math that matters:

Be 1% better daily = 37x better in a year.

Small habits create big wealth.

Consistency beats intensity.

Ancient wisdom, modern proof: The Babylonians knew compound interest was magic. Hardy shows it works for everything.

10. 'The Automatic Millionaire' by David Bach

Bach's premise is that you can't budget your way to wealth if you rely on willpower. Make it automatic, and you'll actually stick to it.

Set it and forget it:

Automate savings before you see the money.

Pay yourself first (there's that phrase again).

The latte factor is real.

Modern Babylon: Taking human error out of wealth building? That's 21st-century wisdom the ancients would've loved.

📘 Want wealth on autopilot? Try Headway for automated money strategies from financial planners!

11. 'The Little Book of Common Sense Investing' by John C. Bogle

Bogle founded Vanguard and championed index funds before they were cool. This little book explains why simple beats complex investing.

The truth about Wall Street:

Most pros can't beat the market.

Fees kill returns.

Boring investing wins.

Babylonian simplicity: Both books say the same thing: get rich slowly. It's not exciting, but it works.

12. 'The 7 Habits of Highly Effective People' by Stephen R. Covey

Not strictly a personal finance book, but these habits will transform your money, along with everything else.

The foundation:

Be proactive (with your finances, too).

Begin with the end in mind (what are your plans for retirement?)

First things first (emergency fund before investments).

Why it's essential: Success habits create financial success. Covey gives you the blueprint that you can apply immediately.

13. 'The Millionaire Fastlane' by M.J. DeMarco

DeMarco calls BS on "get rich slow." He argues for building businesses that create wealth in years, not decades.

The fast track:

Time is more valuable than money.

Create systems that scale.

Own, don't just earn.

For the impatient: If Babylon's patience feels too slow, DeMarco offers the entrepreneur's path to personal wealth.

📘 Ready to accelerate wealth? Get Headway for entrepreneurial shortcuts from business builders!

14. 'Your Money or Your Life' by Vicki Robin

Robin reframes everything: money equals life energy. Every purchase costs you hours of your life. Still want that gadget?

The wake-up:

Calculate your real hourly wage (it's less than you think).

Track where your life energy goes.

Align spending with values.

Life-changing perspective: This New York Times bestseller makes you question everything. It's perfect for after Babylon; it makes you value everything.

Ready to level up your money game? Try Headway today!

Look, we get it. You've got 14 books on your list now, but when exactly are you supposed to read them? Between work, Netflix, and pretending to meal prep?

That's where Headway comes in. We've turned these financial classics (including 'The Richest Man in Babylon') into 15-minute summaries. Listen during your commute. Read during lunch. Learn while you're at the gym pretending to work out.

Gain financial wisdom when you have time. Headway gives you key insights from the best money books.

Download the app today to start making smarter financial moves tomorrow.

Frequently asked questions about books like 'The Richest Man in Babylon'

Who wrote 'The Richest Man in Babylon'?

George S. Clason, an American businessman who understood that nobody wants to read a boring finance textbook. He published pamphlets for banks and insurance companies in the 1920s, packaging timeless money wisdom in entertaining stories. His genius was making financial advice feel like bedtime stories rather than homework.

Is it a true story?

Nope, it's fiction set in ancient Babylon. But the money advice? That's as real as your credit card bill. Clason invented characters like Arkad and Bansir to deliver genuine financial principles. The stories are made up, but the lessons about compound interest, saving, and investing are absolutely legit and proven.

Is 'The Richest Man in Babylon' still relevant in 2025?

Absolutely. Save first, invest wisely, and avoid debt — that advice worked in ancient Babylon, and it'll work when we're all living on Mars. The core principles haven't changed because human nature hasn't changed. We still overspend, undersave, and chase quick wins. Clason's parables remain the perfect reality check for modern money problems.

Which book should entrepreneurs read?

Try 'The 4-Hour Workweek' by Tim Ferriss. It's not just about working less — it's about building systems that work without you. Ferriss shows how to automate income, delegate tasks, and design a business around your life instead of the reverse. That's why it's perfect for anyone tired of the hustle-until-you-die mentality.

What's most similar to Clason's parables?

'Rich Dad Poor Dad' tells money lessons through stories. Same vibe, modern setting. Kiyosaki uses two father figures to contrast money mindsets, just like Clason used Babylonian merchants to teach saving. Both books can make you rethink everything through simple narratives that stick way better than lectures ever could.

What's the best book for total beginners in personal finance management?

'The Millionaire Next Door' — it'll completely change how you think about wealth. Plus, it's an easy read. The research-backed stories show that real millionaires aren't flashy; they're frugal, focused, and boring. It demolishes every myth about money and gives you a practical roadmap anyone can actually follow.

How can Headway help me read more books like 'The Richest Man in Babylon'?

Headway breaks down bestselling books into bite-sized summaries. It's perfect for when you want wisdom without the 300-page commitment. With Headway, you get the key insights in 5-15 minutes. Both text and audio options are available.