Morgan Housel's bestseller doesn't talk about boring stuff like charts or numbers. Instead, it shows you why your brain tricks you into bad money choices.

We found the best books like 'The Psychology of Money' that discuss the same topics. Each one looks at why people are so weird with money and human behavior.

Many are summarized on the Headway app, so you can absorb these life-changing concepts faster than ever. Want to start transforming your relationship with money today?

Download Headway and dive into thousands of game-changing books.

Quick answer: What are the best books like 'The Psychology of Money?'

'Rich Dad, Poor Dad' by Robert T. Kiyosaki

'The Richest Man in Babylon' by George S. Clason

'Atomic Habits' by James Clear

'The Intelligent Investor' by Benjamin Graham

'Your Money or Your Life' by Vicki Robin

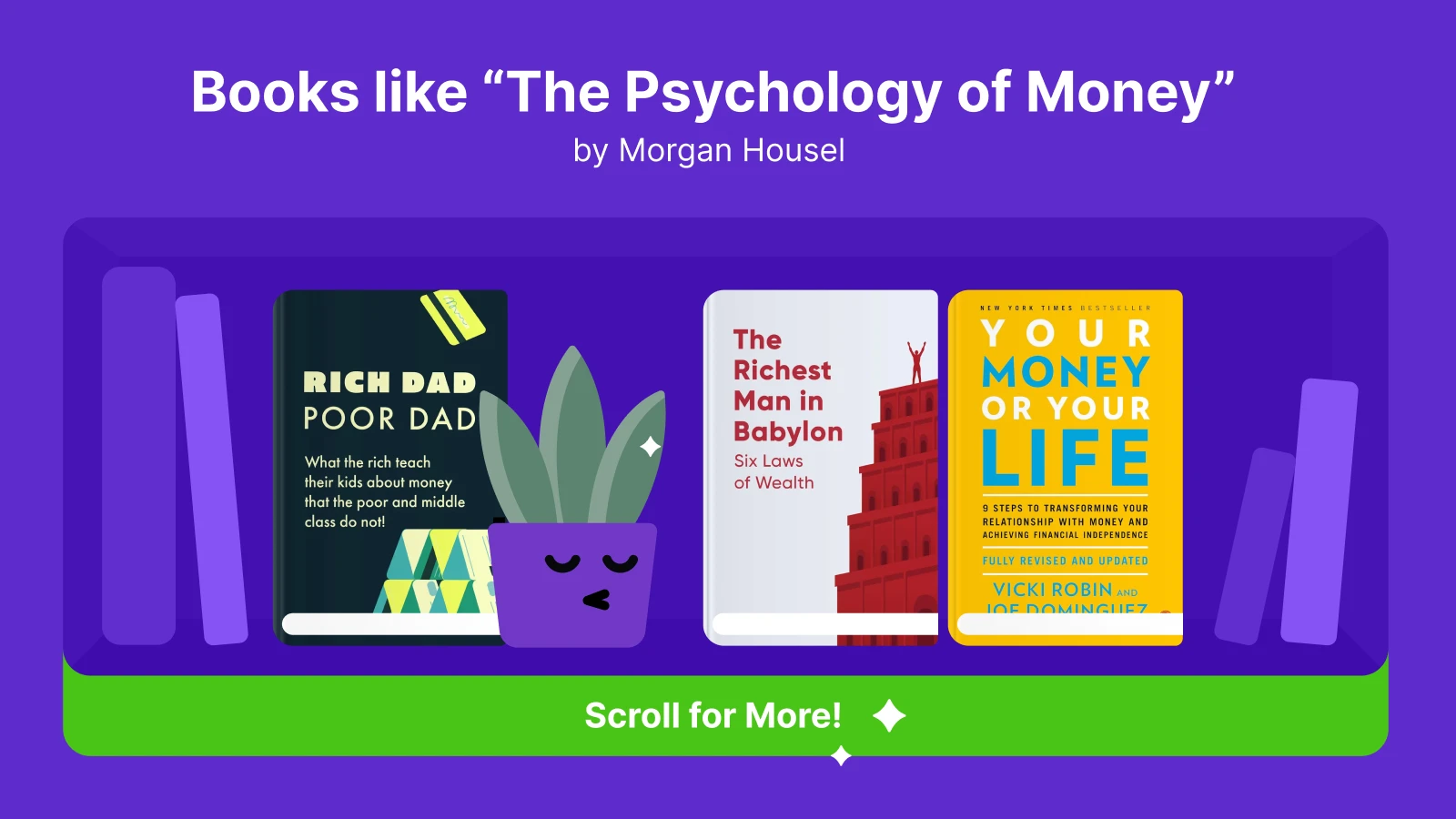

13 best books similar to'The Psychology of Money'

Want more cool ideas about money and human behavior? These good books will keep you reading. Some talk about investing and the stock market. Others show you how rich people think differently from everyone else.

Every book gives you advice you can use today. Whether you're trying to handle personal finance better, want to start startups, or just wonder why smart people make dumb financial decisions.

1. 'Rich Dad, Poor Dad' by Robert T. Kiyosaki

Two dads. Two totally different ways to think about money. One stayed broke his whole life. The other got rich.

Robert T. Kiyosaki turned this story into a huge hit. This bestselling author doesn't just tell you what happened. He shows you why it happened.

The "Poor Dad" did what most people do: get good grades, find a safe job, work until you're old.

The "Rich Dad" did something else. He purchased assets that generated income, such as real estate, and focused on achieving financial independence.

But here's the cool part: it's not really about Kiyosaki's childhood. It's about two ways to think. One keeps you stuck working forever. The other helps you achieve financial freedom and build your net worth.

What makes it similar:

Financial education beats knowing fancy stuff every time.

How you think decides if you get rich or stay broke.

What you do with money matters more than how much you make.

Both books tell you that everything you think about building wealth might be wrong.

📘Read more books in less time with Headway book summaries!

2. 'The Richest Man in Babylon' by George S. Clason

Old wisdom meets new money problems.

George S. Clason wrote these stories almost 100 years ago. He set them in ancient Babylon, the first major city in history to have significant wealth.

The advice? Still works for real life today. Save some of every dollar you make. Make your money work for you. Don't get greedy with investments you don't understand.

Sounds easy, right? Try doing it for twenty years straight.

The smart thing about this book is how it tells stories. Instead of boring personal finance lectures, you get fun tales that stick in your head. The ideas work great for today's business decisions and investment choices.

What makes it similar:

Stories make financial education easy to remember.

Saving and investing aren't optional - you have to do them.

What you choose to do creates your money results.

Both books focus on advice you can actually use in real life.

3. 'Your Money or Your Life' by Vicki Robin

What if everything you think about money is backwards?

Vicki Robin asks hard questions about your financial life.

How much is your time really worth? Are you trading your life for stuff you don't really need?

What would happen if you stopped buying things to impress people you don't even like?

This book doesn't tell you to eat rice and beans forever. Instead, it makes you think about spending money on things that actually matter to you.

The goal isn't to be cheap. It's about figuring out what truly makes you happy and achieving financial independence.

What makes it similar:

Both books look at how you really feel about money and personal finance.

Thinking before you spend beats buying stuff without good decision-making.

Financial freedom helps you live a better life.

They care about making your whole life better, not just having more money.

📘Get the Headway app and level up your reading skills!

4. 'The Millionaire Next Door' by Thomas J. Stanley

Your rich neighbor doesn't appear to be rich.

Thomas J. Stanley spent decades studying millionaires all over America. His big discovery? Most wealthy people live in ordinary neighborhoods, drive older cars, and use coupons.

Even billionaires admit that these same boring habits contributed to their success. Being careful with money wins. Showing off loses.

This book will change the way you think about wealthy people forever.That person driving the beat-up car might have more money than the guy in the fancy BMW.

What makes it similar:

Being careful with money creates real wealth and builds net worth.

Both books demonstrate that what most people think about wealthy individuals is incorrect.

Living on less than you make isn't optional - you have to do it.

Smart financial decisions beat impressive ones every time.

📘Stop scrolling, start growing with the Headway app!

5. 'The Simple Path to Wealth' by J.L. Collins

Wall Street wants you to think investing is hard. It's not.

J.L. Collins cuts through all the confusing stuff about the stock market. Forget day trading and trying to pick winning stocks.

His approach focuses on index funds, mutual funds, and ideas so simple that even your little brother could follow them.

The best part is how simple it is. You don't need to become a money expert or watch Wall Street all day. Just make smart financial decisions over time and let compounding do the work.

What makes it similar:

Hard money ideas become easy for regular people.

Smart, steady investing beats get-rich-quick tricks.

Financial independence is achievable for ordinary people.

Thinking long-term is more effective than getting excited about short-term things.

📘Find more insights in Headway book summaries!

6. 'I Will Teach You To Be Rich' by Ramit Sethi

Don't worry about the flashy title. This isn't a scam.

Ramit Sethi wrote this for young people who want straight talk about personal finance. No mean lectures about skipping coffee.

No impossible budgets that nobody follows. Just real advice on handling money and making investment choices that work for building wealth.

The book does exactly what it says - it gives you a plan for financial freedom without having to live like a monk.

What makes it similar:

Real, step-by-step advice for handling personal finance.

Financial literacy helps you build your net worth.

Making smart financial decisions leads to lasting financial success.

Both books focus on practical applications that work in real life.

📘Download the Headway app and become more productive, starting now!

7. 'The Intelligent Investor' by Benjamin Graham

Warren Buffett says this is the best book about investing ever written.

Benjamin Graham basically invented value investing. His ideas still guide Wall Street today, decades after he wrote them.

He explains the big difference between investing and gambling, why controlling your emotions matters more than predicting the stock market, and how to protect yourself from your own bad financial decisions.

Warning: this book is pretty hard to read. However, if you're serious about understanding investing and building wealth, you should read it.

What makes it similar:

Your emotions and biases drive your financial decisions.

Smart, careful value investing beats following hot tips.

Understanding how markets work and human behavior is important.

Both books demonstrate how controlling your emotions can improve your financial results.

📘Try Headway and turn reading into a self-growth habit!

8. 'The Total Money Makeover' by Dave Ramsey

Dave Ramsey doesn't make anything sound easy when it's not.

His step-by-step way to financial independence is honest and sometimes hard to hear. But it works.

Ramsey focuses on getting rid of debt, building emergency funds, and creating money systems that actually stick for your financial life.

No shortcuts allowed. No excuses accepted. Just proven methods that have helped millions of people fix their personal finance problems.

What makes it similar:

Clear, step-by-step directions for getting financial freedom.

Good habits with money aren't suggestions - you have to do them.

Making smart financial decisions can completely change your money situation.

Both books care more about systems that work than fancy theories.

📘Explore the Headway app for quick lessons from nonfiction bestsellers!

9. 'Atomic Habits' by James Clear

This New York Times bestseller isn't about money. But maybe it should be.

James Clear breaks down how small changes create huge results over time. What he says about building good habits applies perfectly to financial decisions, investing habits, and wealth-building strategies.

After all, getting rich is really about developing better daily habits with money.

Want to build wealth? Start by building better money habits and decision-making skills.

What makes it similar:

Small, steady actions create long-term success and personal growth.

Real strategies for changing human behavior and making better choices.

Understanding how people work helps you reach financial independence. • The power of tiny changes over time is incredible for building wealth.

📘Add the Headway app to your productivity checklist!

10. 'The Barefoot Investor' by Scott Pape

Scott Pape keeps personal finance simple.

His straightforward way to financial independence focuses on steps that anyone can follow.

No confusing words. No complicated strategies that need a college degree. Just clear, real advice for building wealth over time.

The Australian point of view adds fresh ideas to money principles that work everywhere in real life.

What makes it similar:

Real, useful advice for handling personal finance.

Financial freedom and independence are goals you can reach.

Simple strategies that work in real life beat complicated theories.

Both books focus on helping regular people build lasting wealth.

📘Read more books in less time with Headway book summaries!

11. 'Think and Grow Rich' by Napoleon Hill

Napoleon Hill spent twenty years studying the most successful people in America.

His ideas about desire, faith, and never giving up have influenced generations of entrepreneurs and people building wealth.

While some parts feel old-fashioned, the main message is still powerful: how you think shapes your financial life more than your situation.

This classic earned its place on every serious list of important finance books and is considered a must-read for personal growth.

What makes it similar:

How you think drives your success in building wealth.

Real advice on setting goals and never giving up.

A positive attitude is essential for financial freedom.

Both books prove that changing how you think changes your money results.

📘Get the Headway app and level up your reading skills!

12. 'Thinking, Fast and Slow' by Daniel Kahneman

Daniel Kahneman won the Nobel Prize for understanding how people make decisions.

This book looks at the biases and mental shortcuts that affect every choice we make - especially financial decisions.

Understanding these mind tricks can make you way better at everything from daily spending to long-term investing and decision-making.

It's heavy reading, but the ideas are worth the work for understanding human behavior.

What makes it similar:

Mind stuff and biases shape every financial decision you make.

Spotting thinking mistakes leads to better, smarter choices.

Careful, logical decision-making is important for money success.

Understanding your own mind makes you better with personal finance.

📘Find more insights in Headway book summaries!

13. 'Talking to Strangers' by Malcolm Gladwell

Malcolm Gladwell looks at why we misunderstand each other so much.

While not specifically about money, this book looks at how our guesses about people can lead us completely wrong. These ideas apply directly to financial decisions, investment choices, and business decisions.

Understanding human behavior better makes you better with money, too.

What makes it similar:

How people act and make decisions is a complex process.

Understanding others makes your personal and financial life better.

Both books provide ideas for making better decisions and avoiding costly mistakes.

Real-world applications of behavioral ideas matter more than theory.

📘Test-drive Headway to build your daily growth habit!

What is 'The Psychology of Money' about?

Morgan Housel spent years examining why some people become extremely wealthy while others remain financially struggling, even when they are familiar with the stock market.

His answer? Wall Street doesn't care how smart you are if you panic every time it goes down.

He tells twenty short stories that illustrate how biases and flawed thinking can harm our financial decisions. He shows why the quiet janitor who saves money for years often gets richer than the fancy investment guy.

It's not about being smart. It's about understanding why you make poor financial decisions and how to improve your decision-making.

The book talks about compounding and how people think, but it never feels like school. Housel writes like he's your friend, not your teacher.

Whether you want to build wealth, save for emergencies, or stop making the same money mistakes, this book helps your financial life.

That's why personal finance experts say this is a must-read. It changed how millions of people think about money.

📘Start making change with Headway!

Read more books like 'The Psychology of Money' with Headway

Want to learn more about personal finance without spending months reading whole books?

The Headway app fixes that problem perfectly. Instead of struggling through thick finance books, you get sharp, short summaries of the best personal finance, investing, and behavioral economics titles.

Audio and text options work with different learning styles, and the features actually help you remember what you learn.

Download Headway today and turn your free time into financial literacy time.

FAQs

What is 'The Psychology of Money' about?

'The Psychology of Money' highlights how our behavior and mindset shape financial decisions, often more than mere knowledge. Embrace its insights to make smarter, more emotionally intelligent financial choices!

How does 'Rich Dad, Poor Dad' compare to 'The Psychology of Money'?

Both 'Rich Dad, Poor Dad' and 'The Psychology of Money' stress the crucial role of financial education and mindset in wealth-building. Embrace their lessons, and you'll be on a powerful path to financial success!

What lessons can I learn from 'The Richest Man in Babylon'?

You can gain valuable financial insights from 'The Richest Man in Babylon' by learning to save a portion of your income, invest wisely, and live within your means. Embrace these lessons to build a secure and prosperous future!

What practical advice does 'Your Money or Your Life' offer?

Transform your relationship with money by evaluating your spending habits and aligning your financial choices with your personal values and life goals. This practical advice empowers you to enhance your overall quality of life!

How can the Headway app help me learn about personal finance?

The Headway app can significantly boost your personal finance knowledge by providing concise summaries of top books in the field, available in both audio and text formats. With its engaging interface and retention tools, you'll master essential concepts efficiently and confidently!