2 Best Venture Capital Books

Discover the best venture capital books to gain insights into the world of investment funding, startups, and entrepreneurial success.

1

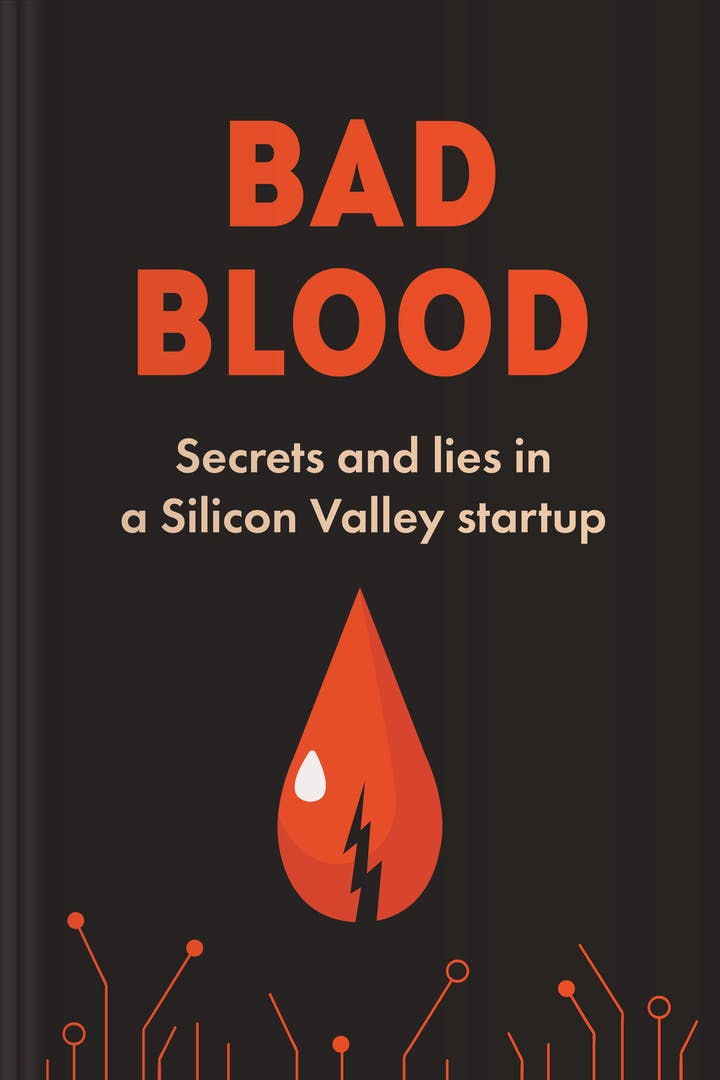

1Bad Blood

by John Carreyrou

What is Bad Blood about?

This gripping non-fiction book delves into the shocking rise and fall of a Silicon Valley startup. Fueled by charismatic leadership and promises of groundbreaking medical technology, the company quickly became a billion-dollar empire. However, behind the scenes, deception, fraud, and a web of lies were unraveling. Investigative journalist John Carreyrou uncovers the truth, exposing the dark secrets and unethical practices that ultimately led to the company's downfall.

Who should read Bad Blood

Entrepreneurs and aspiring startup founders seeking cautionary tales and lessons.

Investors and venture capitalists interested in the dark side of Silicon Valley.

Anyone fascinated by corporate scandals and the pursuit of truth.

2

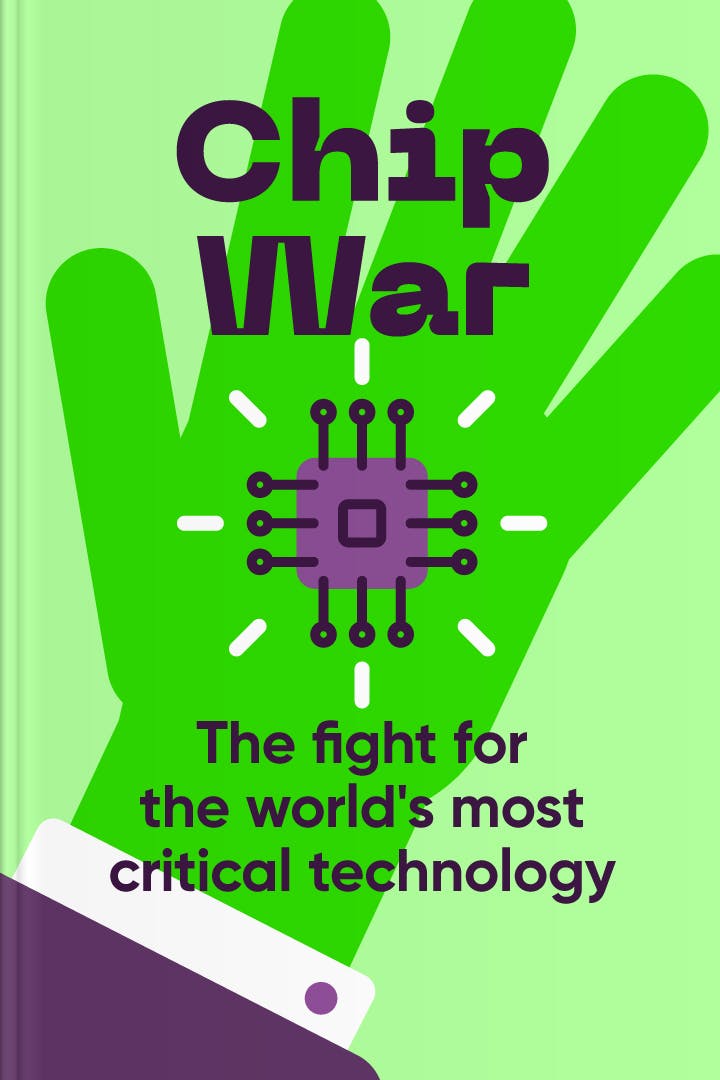

2Chip War

by Chris Miller, Prof.

What is Chip War about?

In this gripping and insightful book, Chris Miller, a renowned professor, delves into the intense battle for the world's most crucial technology. Exploring the high-stakes world of chip manufacturing, Miller uncovers the cutthroat competition between global powers, revealing the economic, political, and security implications at stake. With meticulous research and expert analysis, "Chip War" offers a compelling narrative that sheds light on the critical role of technology in shaping our modern world.

Who should read Chip War

Technology enthusiasts and professionals interested in the global chip industry.

Business leaders and investors seeking insights into the competitive chip market.

Students and researchers studying the impact of technology on global economies.